Wrongful actions and professional misconduct in Multilateral Development Banks (MDBs) financed projects is not a sporadic phenomenon. This has led to the establishment of the lists of penalized or excluded companies, also called debarred, which are declared ineligible to bid on such contracts.

The debarment system applied by MDBs comes into effect in one of the four sanctionable practices: fraud, corruption, collusion, or coercion. Debarment results in sanctions applied for a period of time, which is dependent on the level of severity of the case. It can last between 3 to 15 years, or permanently in extreme cases.

Lists of sanctioned organizations usually differ from institution to institution. However, in April 2010 five MDBs, the World Bank, African Development Bank, Inter-American Development Bank, Asian Development Bank and European Bank for Reconstruction and Development signed the Cross-Debarment agreement to mutually enforce other’s debarment actions.

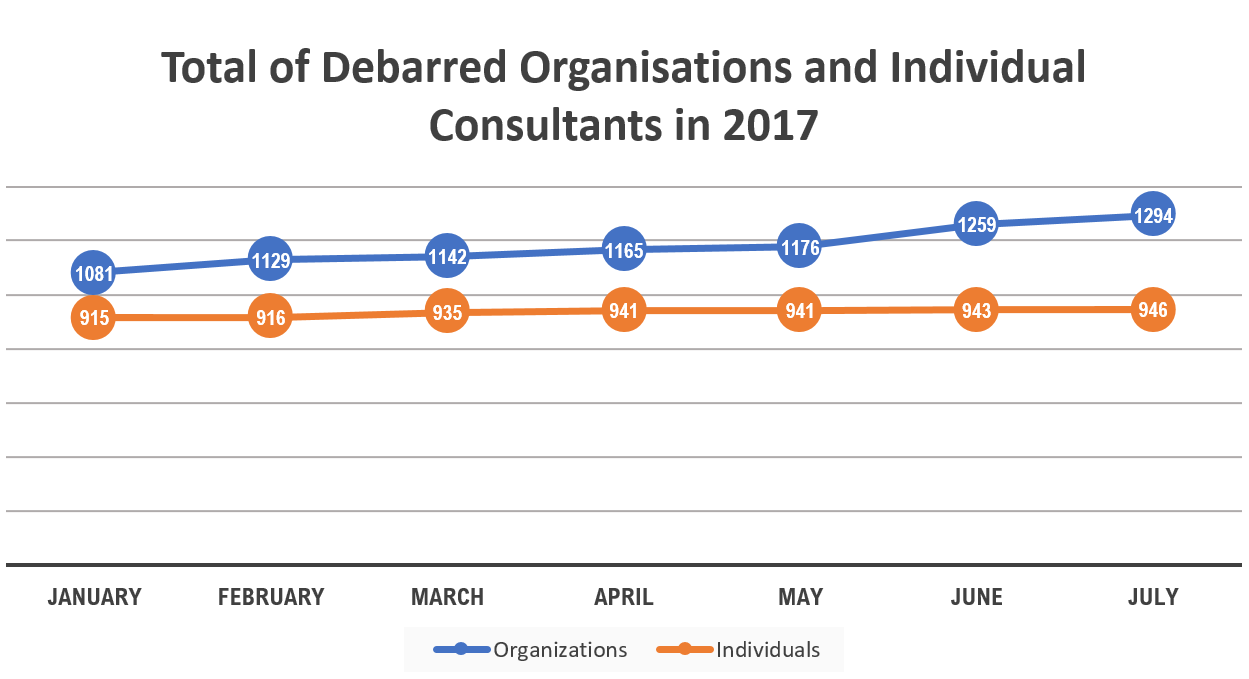

Over the last period the increased number of companies identified committing fraud or other misconducts by the MDBs demonstrates the engagement of the Banks in the fight against corruption.

The graph below shows the total number of organisations and individuals debarred by MDBs till July 2017.

Data extracted from www.developmentaid.org

It is worth noting that the debarment system is a “quasi-judicial administrative process”. This means that there is no legislation to enforce criminal or civil penalties. However, cases of past debarment have resulted in investigations launched by local police at the request of MDBs which led to raids in the company’s office, the arrest of the key management involved in the fraud and even suspension of the company’s activities.

“For businesses, particularly those that rely heavily on MDB or government contracts, debarment represents a significant and undeniable loss of credibility”, says Mr. Sergiu Casu, director of Business Development at DevelopmentAid. “This impacts the organisation’s ability to generate revenue. Therefore, entities that form consortiums with the aim to increase their chances of winning contracts, need to perform a due-diligence check on their partners. Fraudulent practices of one partner will inevitably lead to a disqualification of the whole joint venture and an investigation, during which temporary sanctions can be applied to all consortium members”, concluded Sergiu.

Debarment, however, also has a positive effect. It excludes dishonest contractors from significant business transactions and sends an important message that sanctionable practices are not and will not be tolerated.

Written by DevelopmentAid